Welcome to Trinus Impact PE Partners 1 LP

Impact with Performance

Sustainable investing has come to the forefront and is now considered an essential part of the investment process.

About

Trinus Impact PE Partners 1 LP is an impact fund focused on delivering impactful outcomes via exposure to natural resources. The fund has a diverse portfolio of long term investments. Our portfolio consists of investments in funds as well as direct investments targeted at the financing of resource assets. It is the belief of our manager that the fundamental characteristics of global population growth and mass urbanization lead to the fact that resources will always be needed despite volatility in the supply and demand cycles, and that by building a wide portfolio of investments that are focused more toward the financing of natural resources that this will provide significant long term capital appreciation, whilst mitigating the risks of commodity volatility.

With the emergence of global electrification the need for certain resources has never been more prevalent. Governments around the World have set targets to achieve a net zero carbon economy which is going to require a significant amount of sustainably and ethically produced raw materials.

Trinus Impact PE Partners 1 LP was established as an exempted limited partnership in the Cayman Islands with the purpose of onboarding the private equity portfolio built by the parent of its General Partners. Trinus Private Equity Partners 1 LP is a 10 year closed ended fund. Trinus Private Equity Partners 1 LP has appointed Trinus Management Limited to manage the portfolio. Trinus Management has a global network of business professionals and specialist advisors with extensive experience in the investment and natural resources sectors.

ESG & Impact

ESG

Environmental, Social and Governance (ESG) investing is becoming the norm

Inaugural ESG funds and ESG investments are occurring with increased frequency. In 2021, a record $US649 billion poured into ESG-focused funds worldwide through November 30, up from the $US542 billion and $US285 billion that flowed into these funds in 2020 and 2019, respectively2. The latest Refinitiv Lipper data shows ESG funds now account for 10per cent of worldwide fund assets and are on track to exceed $US50 trillion by 2025, representing more than a third of the projected $US140.5 trillion in total global assets under management3. Some of the largest of these funds include KKR’s Global Impact Fund ($US1.3 billion) and Apollo Global Management’s Impact Mission Fund (targeting up to $US1.5 billion), illustrating the importance of ESG investing to some of the largest sponsors in the world.

Impact

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending on investors' strategic goals.

The growing impact investment market provides capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education.

Impact investing challenges the long-held views that social and environmental issues should be addressed only by philanthropic donations, and that market investments should focus exclusively on achieving financial returns. The impact investing market offers diverse and viable opportunities for investors to advance social and environmental solutions through investments that also produce financial returns.

Many types of investors are entering the growing impact investing market.

Here are a few common investor motivations:

Banks, pension funds, financial advisors, and wealth managers can provide client investment opportunities to both individuals and institutions with an interest in general or specific social and/or environmental causes.

Institutional and family foundations can leverage significantly greater assets to advance their core social and/or environmental goals, while maintaining or growing their overall endowment.

Government investors and development finance institutions can provide proof of financial viability for private-sector investors while targeting specific social and environmental goals.

Private Equity

Simply, Private Equity has outperformed other asset classes and experienced less volatility since 2008. The fundamentals of investing via private equity are strong.

Private Equity can offer fund diversification as more and more managers grow Assets Under Management by creating long-term funds, industry specific funds, growth funds, credit funds, geographically focused funds, ESG fund and impact funds.

Private equity managed to post its second-best year ever in 2022, riding a wave of momentum coming off the industry’s record-breaking performance in 2021.

But spiking interest rates caused a sharp decline in deals, exits, and fund-raising during the year’s second half, almost certainly signaling a turn in the cycle.

For the first six months of 2022, the industry extended 2021’s record deal activity, despite persistent inflation, the invasion of Ukraine, and growing tensions with China. Then, in June, when US central bankers issued the first in a series of three-quarter-point interest rate hikes, and their colleagues around the world followed suit, banks pulled back from funding leveraged transactions and dealmaking fell off a cliff, pulling exit and fund-raising totals down with it.

Given the heights from which they fell, buyout deal value ($654 billion), exits ($565 billion), and fund-raising ($347 billion) all finished 2022 with respectable totals in a historical context. But the sudden reversal marked the end of an up cycle that has endured (with a brief Covid break) since 2010, when the industry emerged from the global financial crisis and produced a 12-year run of stunning performance.

The number of US public companies has declined by about a third over the last 25 years, and the remaining pool is dominated by a handful of large tech firms that hold disproportionate sway over the indexes. That makes it increasingly difficult to find adequate diversification in the public markets. Private market returns, meanwhile, are outpacing public returns over every time horizon, while alternative funds provide access to the broad global economy and the fullest range of asset classes. These advantages explain why private markets continue to grow relative to the public markets.

A year ago, the growth equity and late-stage venture segments were on fire. But, like buyout, these funds saw a large decline in activity in the second half of 2022. Overall, deal value dropped 28%.

Lower valuations have put growth and venture funds in a holding pattern. Not only have the companies they acquired in recent years come down in value, making buyers and sellers reluctant to transact, but the IPO markets are virtually shut down, dramatically slowing the growth of the market’s favorite exit channel.

Deal activity is unlikely to recover until valuations return to previous levels or enough time passes that assets are able to grow into their earlier valuations by generating higher earnings at lower multiples.

FUND STATISTICS

PORTFOLIO CONSTRUCTION

Trinus PE takes minority positions in funds and growth companies it currently has 8 holdings which on average represent a 4.21% holding in each company, with the lowest holding being 1.78% and the highest being 8%

Direct Investments: Projecting significant increase in value over the life of the fund.

Fund Portfolio: Increases and diversifies growth exposure.

Investments By Type

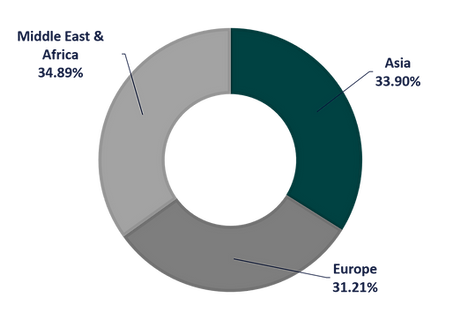

Investments By Region

Investments By Vintage

Our Approach

Our Criteria

Financial return: How aligned is the investment with the overall fund strategy to generate positive impact while delivering our targeted financial return?

Impact: How does the investment address a societal or environmental challenge? What systematic/wider impact will occur from the investment? Does this provide additional value and effect positive change?

Environmental, Social & Governance (ESG) Factors: What are the ESG risks and how can they be mitigated? Do any ESG opportunities exist that would also improve business performance?

Additionally: Does the investment lead to other outcomes which would not otherwise occur or does it just displace comparable societal benefits? What value can be added to the investment’s development and growth?

How We Look To Invest

We invest in Companies or funds that can demonstrate proven business models that have high development potential and a measurable and scalable social or environmental impact.

We invest through equity structures delivering value and ensuring that our investment contributes to a positive impact is our priority and where appropriate we work closely with investee companies throughout the life of our investments to achieve this.

We look to invest in Europe, Asia and The Middle East and Africa with a goal to create impact where the need for it is highest.

We define investment themes and develop strategies based on the long-term viability and growth possibilities of companies or funds that we invest in as well as the potential scale and depth of impact that these companies or funds are attempting to deliver.

Contact

One Capital Place

PO Box 847

Grand Cayman KY1-1103

Cayman Islands